With over 200 million middle-class Chinese actively exploring overseas property investment, China has become the world’s largest source of cross-border real estate buyers. Yet traditional marketing channels fail here—Baidu dominates 72% of property-related searches, while platforms like WeChat and Xiaohongshu shape 80% of purchase decisions. To capture this market, global real estate brands must master Chinese SEO with hyper-localized strategies. Here’s your actionable blueprint.

I. Decoding China’s Overseas Property Searchers

A. Investment Priorities & Pain Points

- Top Destinations:

- 44.7% of Chinese buyers target the US and Thailand

- Japan, UK, and Australia follow closely, with Germany rising as a European hotspot

- Core Motivations:

- 76% seek asset preservation, while education/immigration drive 24%

- Critical Concerns:

- 88% prioritize transaction security and platform credibility over returns

- Lack of localized policy insights (e.g., visa rules, tax laws) stalls decisions

B. Search Behavior Shifts

- Mobile-First Research:60% use Baidu’s mobile search; sites loading >2 seconds lose 50% of traffic

- Keyword Patterns:

- “泰国学区房投资回报率” (Thailand school district ROI)

- “日本民宿经营合法攻略” (Japan Airbnb legal guide)

II. 4 Pillars of Chinese SEO for Overseas Property

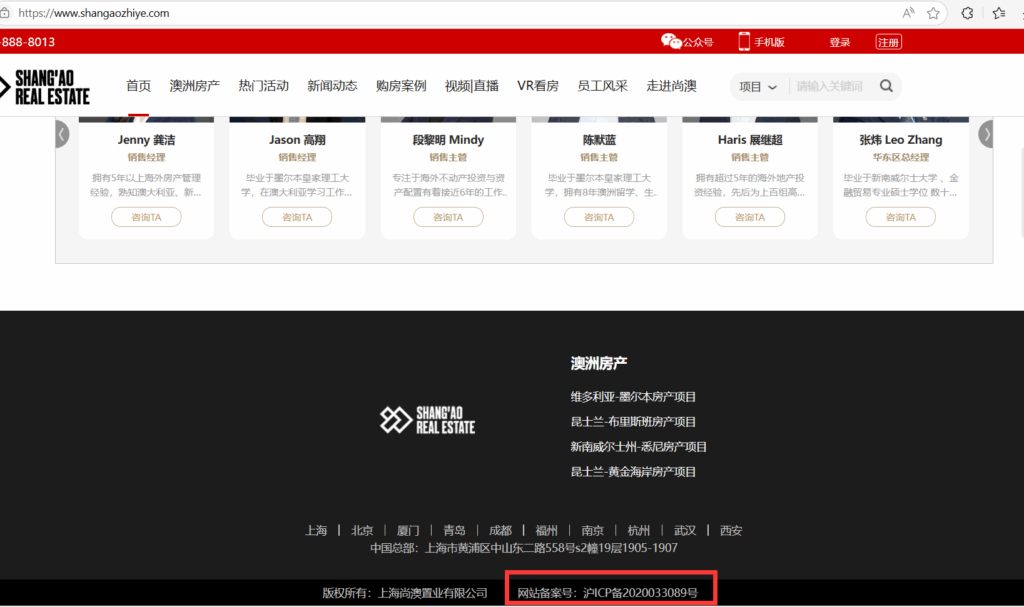

1. Technical Localization: Build Trust with Baidu

- Hosting Compliance:

Use a .cn domain with ICP license (mandatory for Baidu indexing). Non-compliant sites are excluded from search results. - Mobile Optimization:

Implement Baidu’s Mobile Instant Pages (MIP). Test speed via Baidu Webmaster Tools. - Block Western Tools:

Replace Google Analytics/Fonts with Baidu Tongji to avoid rendering errors.

2. Content Strategy: Answer Unspoken Concerns

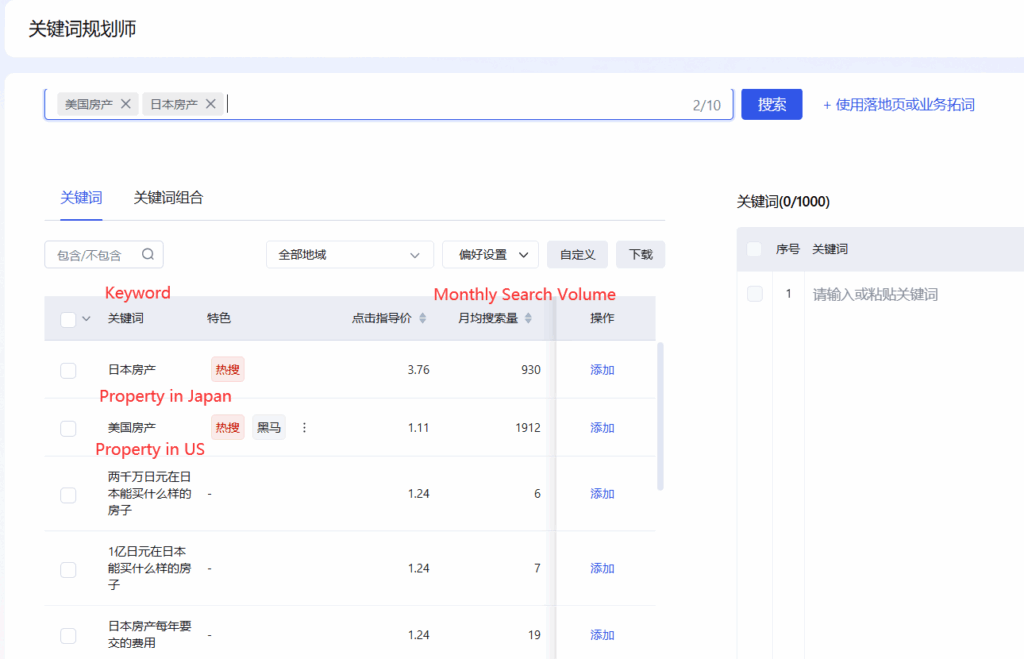

- Keyword Localization:

Use Keyword Planner to target long-tail phrases like:- “美国避税房产推荐” (Tax-advantaged US properties)

- “英国学区房出租收益率” (UK school district rental yield)

- High-Value Formats:

- Policy Guides: “2025日本购房移民新政解读” (Japan immigration policy updates)

- ROI Calculators: Interactive tools comparing rental yields in Bangkok vs. Osaka

- UGC Testimonials: Video tours from Chinese owners in London/LA

3. Leverage China’s Social-Commerce Ecosystem

- WeChat Official Accounts:

Publish articles like *“澳洲购房10大陷阱-律师亲授避坑指南”* (10 Australian property pitfalls) with mini-programs for instant consultation booking. - Xiaohongshu (Little Red Book):

Collaborate with KOLs on “看房日记” (property review diaries), tagging projects with #海外资产配置 (#overseas asset allocation). - Douyin (TikTok):

15-second clips: “3分钟看懂加拿大购房税费” (Canada property taxes explained).

4. Authority Building: Combat Mistrust

- Showcase Credentials:

Display partnerships with Chinese banks (e.g., China Merchants Bank) or platforms like Haijupai 8. - Localized Case Studies:

Highlight projects with >20% Chinese ownership (e.g., “50户上海家庭投资的东京公寓”).

III. Pitfalls to Avoid

- Ignoring Baidu’s E-E-A-T: Show expertise using .gov.cn backlinks (e.g., partnerships with Chinese real estate associations).

- Generic Translations: “Luxury waterfront home” → “免税海景度假资产” (tax-free seafront asset).

- Underestimating Mobile UX: 70% of payments occur via WeChat Pay/Alipay—integrate these at inquiry stage.

Your 2025 Action Plan

- Secure ICP备案 + .cn domain

- Optimize for 5-10 Baidu long-tail keywords (e.g., location + policy + ROI)

- Launch WeChat/Xiaohongshu accounts with KOL collaborations

- Publish quarterly market reports on Baidu Wenku

- Monitor rankings via residential IP proxies (e.g., IPIPGO) to avoid data distortion

The Bottom Line:

Chinese SEO isn’t about translation—it’s about becoming a trusted insider in China’s investment psyche. By aligning with Baidu’s algorithms and addressing unspoken anxieties, global real estate brands can convert China’s massive demand into loyal clients.

Need an audit on your Chinse SEO?Please feel free to reach us via service@baiduseopro.com.